Executives push up their stock prices and then cash in their multimillion-dollar options, a process known as " pump and dump". With its success in the bull market brought on by the dot-com bubble, Enron seeks to beguile stock market analysts by meeting their projections.

Pai uses his money to buy a large ranch in Colorado, becoming the second-largest landowner in the state.

Despite the amount of money Pai has made, the divisions he formerly ran lost $1 billion, a fact covered up by Enron. Pai abruptly resigns from EES with $250 million, soon after selling his stock. Clifford Baxter, an intelligent but manic-depressive executive and Lou Pai, the CEO of Enron Energy Services, who is notorious for using shareholder money to feed his obsessive habit of visiting strip clubs. Skilling hires lieutenants who enforce his directives inside Enron, known as the "guys with spikes." They include J. This creates a highly competitive and brutal working environment. With the vision of transforming Enron from an energy supplier to an energy trader, Skilling imposes his interpretation of Darwinian worldview on Enron by establishing a review committee that grades employees and annually fires the bottom fifteen percent, a process nicknamed within the company as " rank and yank". This gives Enron the ability to subjectively give the appearance of being a profitable company even if it wasn't. Lay hires Jeffrey Skilling, a visionary who joins Enron on the condition that they use mark-to-market accounting, allowing the company to record potential profits on certain projects immediately after contracts were signed, regardless of the actual profits that the deal would generate. After these facts are brought to light, Lay denies having any knowledge of wrongdoing. However, the traders are fired after it is revealed that they gambled away Enron's reserves the company is narrowly saved from bankruptcy by the timely intervention of executive Mike Muckleroy, who managed to bluff the market long enough to recover Borget's trading losses and prevent a margin call. After auditors uncover their schemes, Lay encourages them to "keep making us millions". One of the traders, Louis Borget, is also discovered to be diverting company money to offshore accounts. Two years after its founding, the company becomes embroiled in scandal after two traders begin betting on the oil markets, resulting in suspiciously consistent profits. The film begins with a profile of Kenneth Lay, who founded Enron in 1985. It was also nominated for Best Documentary Feature at the 78th Academy Awards in 2006.

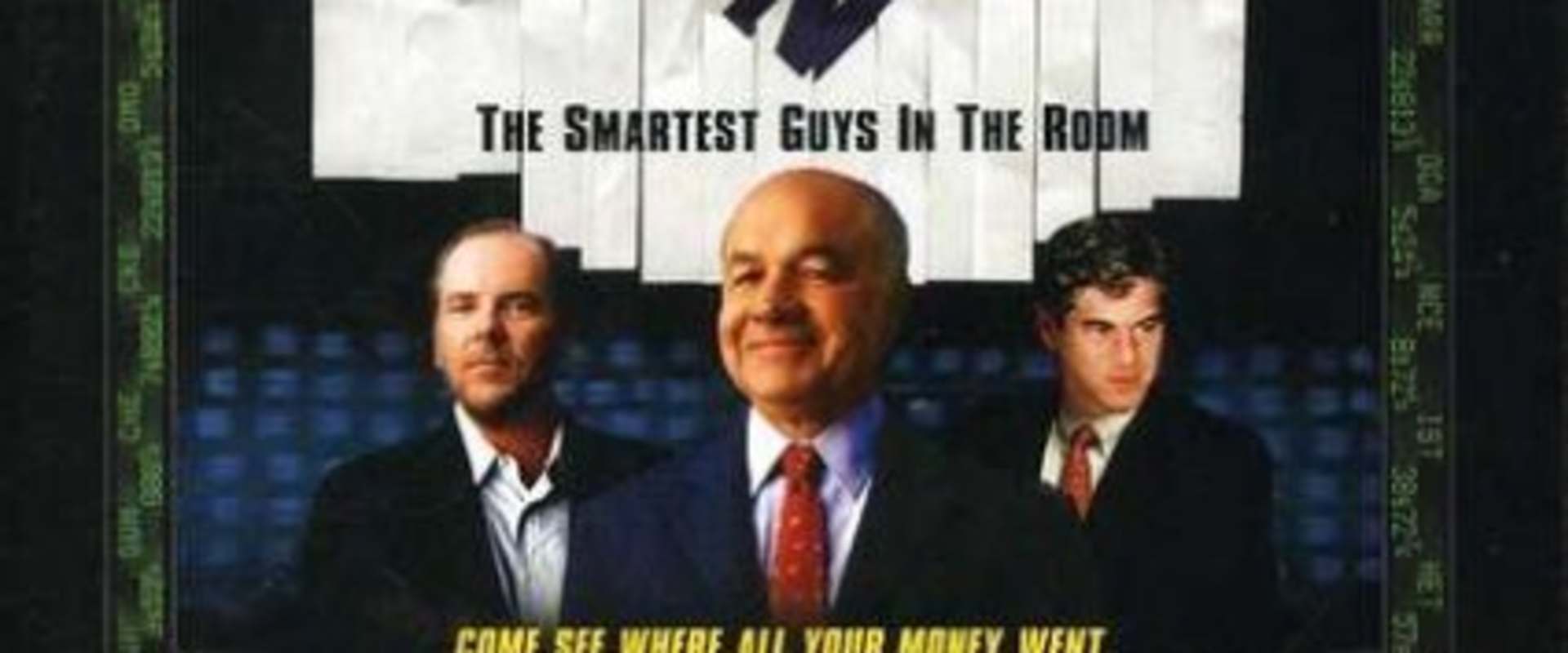

The film won the Independent Spirit Award for Best Documentary Feature and Best Documentary Screenplay from the Writers Guild of America. The film features interviews with McLean and Elkind, as well as former Enron executives and employees, stock analysts, reporters and the former Governor of California Gray Davis. The film examines the 2001 collapse of the Enron Corporation, which resulted in criminal trials for several of the company's top executives during the ensuing Enron scandal it also shows the involvement of the Enron traders in the California electricity crisis. McLean and Elkind are credited as writers of the film alongside the director, Alex Gibney. Enron: The Smartest Guys in the Room is a 2005 American documentary film based on the best-selling 2003 book of the same name by Fortune reporters Bethany McLean and Peter Elkind, a study of one of the largest business scandals in American history.

0 kommentar(er)

0 kommentar(er)